December 2023 Market Commentary

- Belvedere Wealth Management

- Jan 11, 2024

- 10 min read

Developed Markets

Executive Summary

The U.S. economy closed 2023 defying expectations of a recession, with gross domestic product (GDP) outpacing forecasts, inflation declining, and employment figures heading north. The year also witnessed the strength of housing demand, as real wages increased, and financial markets at all-time highs. The third-quarter annualised expansion for the U.S. was significantly higher than the 2.2% and 2.1% annual growth recorded in the first and second quarters respectively. Notably, consumer spending and business growth continued to lead growth, as the economy adjusted to shine forth despite the Fed’s aggressive stance in combating inflation.

The economic activity of the UK was marred by the decline in GDP, leading to households facing pressure from higher living expenses. The declining level of prices and weak economic growth are forecasted to lead the Bank of England to cut its benchmark interest rates in 2023, as apex banks across major economies begin to halt on rate hikes that have spurred borrowing costs to record levels.

Market Summary

Global equities stretched their weekly winning streak to six as of the last trading week of 2023, boosting the year-to-date return of the MSCI All Country World Index to an impressive +15% and lifting the S&P 500 Index into bull market territory for 2023. The S&P 500 wrapped up 2023 with a surprising gain of +24%, despite falling -0.28% on the last trading day of the year. The YTD gain of the broad index came as inflation slowed, resilience in the economy, and the Federal Reserve signalled an end to its interest rate hike campaign.

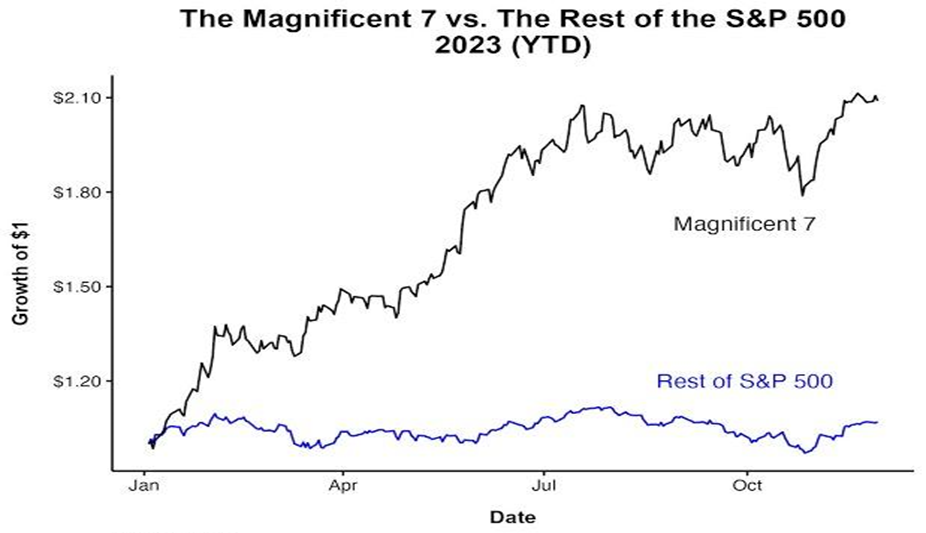

Stocks resurged in 2023 after a rough 2022, with the positive highlights of the year hovering on the excitements around artificial intelligence, triggering big gains for the “Magnificent 7” stocks like Nvidia and Microsoft, with the enthusiasm of this portfolio of stocks bolstering the major indexes in the US. The S&P 500 rallied +11.2% in the fourth quarter, leading to a +4.4% rise in December 2023, and +24.2% on a year-to-date basis.

In its final policy meeting of the year on December 13th, 2023, the Federal Reserve held its benchmark interest rate for the third consecutive time, setting the pace for the equity and fixed-income markets to close the year on a high note, and the apex bank’s decision for multiple cuts to come in 2024 and beyond. Hence, we solicit investors to remain open-minded for a juggling of their investment positioning in the new year.

Positive fundamentals and sustainable growth potentials make dividend-paying companies attractive, both of which make investors well-positioned to enter 2024 on a cautiously optimistic note. However, their capital flexibility allows them to return more cash to shareholders via increasing dividend payments. The infusion of optimism to investing in the markets has been spurred by inflation and macroeconomic data indicating a halt to the US Federal Reserve’s rate hike cycle and triggering market anticipation for as many as five rate cuts in 2024, beginning as early as March. However, we remain sceptical about the implications for economic growth if that many rate cuts were to materialise.

U.S. Economy Defies Odds to Avoid Recession in 2023

The U.S. economy wrapped up a volatile year defying the recession prediction, with GDP outpacing expectations, inflation trickling down, and robust employment numbers. Additionally, the year saw housing demand remain strong, real wages increasing, and financial markets at all-time highs. In 2022, economists increasingly predicted the world’s largest economy to experience a recession in the forthcoming year, but revisions were quick in thwarting earlier expectations of a recession as the economy continued to surge.

The Federal Reserve embarked on a 20-month rate hike campaign to slow America’s economy to combat inflation, ignoring the chances of millions of Americans losing their jobs. The Fed raised its main interest rate 11 times over that period – and at a historic pace, with the apex bank going aggressive at its fastest since the last inflation crisis 40 years ago in the U.S.

Consequently, this reflected monetary events in 1980, when the Fed hiked rates so high it plunged the economy into the deepest recession since the Great Depression. However, the Fed’s attempt in nearly two years to halt America’s economy may have successfully checked inflation without plummeting the U.S. into a recession.

United States YoY Inflation Rate (December 2022 – November 2023):

America’s GDP, the broadest measure of economic output, increased at an annualised rate of 5.2% in the third quarter of 2023, stressing the economy’s resilience amid the increased borrowing costs and high prices. Consumer spending, the engine room of the U.S. economy, also grew in Q3 2023 by 3.6%, signalling America's prowess in maintaining purchases.

The economic performance for 2024 is packed with potential shifts, also dependent on the election outcomes in November with expectations of a tight race that could spell economic turmoil for the U.S. In our opinion, a close election could result in social unrest that would spread quickly to impact the equity and bond markets. Given the fragility of consumer and business confidence, this could cause a jittery in consumer spending and business investment. Additionally, the risk of a government shutdown remains prevalent with deadlines approaching in January and February for Congress to pass spending bills to avoid a shutdown.

Persistent Economic Challenges Mark UK’s Struggles Throughout 2023

The UK's economic activity witnessed a disappointing run in 2023, with GDP unexpectedly shrinking, as households came under intense pressure from higher living costs. Inflation has fallen from more than 10% in January 2023 to 3.9% in November 2023, driven mainly by cooling energy prices. However, the annual rate has remained fixated at persistently higher levels than anticipated, as the UK grapples with the highest rate in the G7.

In our opinion, the cooling inflation and weak economic growth will force the Bank of England to start cutting interest rates from the current level of 5.25% as early as the summer, as central banks across advanced economies begin to hold steady the record increase in borrowing costs for decades. However, there are risks that inflation could remain persistently high amid geopolitical tensions and a tight UK labour market. The Bank affirmed its close watch for signs of inflation persistence from employment growth and prices in the services sector.

Furthermore, weak activity and higher borrowing costs are expected to weigh heavily on employers’ hiring intentions in 2024, with forecasters anticipating a rise in unemployment. The UK is entering an election year with the economy struggling to grow as households and businesses come under pressure from rising borrowing costs, higher taxes, and elevated cost of living. Prime Minister Rishi Sunak is expected to send voters to the polls in 2024 having declared victory on his primary economic target to halve inflation in 2023. However, the Bank of England has warned that the UK is facing a 50-50 chance of a recession while living standards are on track to be lower at the end of the current parliament tenure in December 2024 than at the start of 2019. While inflation is expected to continue to fall in 2024, the apex bank is expected to remain above its government-set target of 2% until the end of 2025, maintaining pressure on households. However, lower inflation does not mean prices are trickling, only that the percentage increase is declining.

Emerging Markets

Executive Summary

China, the world’s second-largest global economy, continues to grapple with the aftermath of the COVID-19 pandemic and other challenges. These include vulnerabilities in the property sector, fluctuations in global demand for China's exports, high debt levels, and fluctuations in consumer confidence. Addressing China's economic deceleration may necessitate additional demand-side measures, such as interest rate reductions or further relaxation of purchase restrictions, to stabilize price expectations and reinforce confidence.

India has held the title of the world's fastest-growing major economy over the past two years and is projected to maintain this position in 2024 as the processes of urbanisation and industrialisation enter a phase of rapid acceleration. S&P Global forecasts strong economic growth for India in the medium term, predicting an annual GDP expansion ranging from 6% to 7.1% during the fiscal years 2024-2026.

Markets Summary

Several major emerging market countries encountered below-average growth throughout 2023, experiencing predominantly stagnant performance year-to-date. China's economic recovery showed irregularities, and the growth of Taiwan and Korea, closely linked to global economic conditions and the semiconductor industry, faced challenges.

The MSCI Emerging Markets Index experienced an increase of +7.04% year-over-year in 2023, after two consecutive declines in the first and second quarters of the year. Notably, the MSCI China All Shares Index outperformed the Emerging Markets ex-China Index for the third quarter of 2023 (-2.72% vs. -3.33%). The quarterly outperformance narrowed the year-to-date performance gap between China and Emerging Markets excluding China, influenced by a surge in semiconductor stocks and a recovery in China that was slower than anticipated.

In 2023, Taiwan, Brazil, and India took the lead in performance, while MSCI China continued to lag. On a sector level, energy and information technology maintained their lead year-to-date. Despite a slight retreat in semiconductor companies during the third quarter, they remain at the forefront for the year. Energy benefited from OPEC's controlled daily barrel supply.

On the flip side, utilities and industrials underperformed in 2023. The healthcare sector faced challenges due to a lack of policy direction and an anti-corruption campaign. The materials sector experienced an oversupply following two tight years and felt the impact of an economic slowdown. Consumer-related sectors also lag, primarily due to low expectations for China's consumer economy in 2023.

The divergence in earnings growth between equities in emerging markets and developed markets is often viewed as a factor influencing their relative performance momentum. Despite the decline in share prices from China, emerging markets have trailed behind developed markets this year, partly due to weaker earnings growth. However, looking ahead to 2024, the current forecasts for earnings growth indicate a positive 9% differential favouring emerging markets (19%) over developed markets (10%), with a 7% positive spread for emerging markets over the United States.

We believe that emerging markets equities are poised to gain more from enhanced economic growth compared to developed markets, particularly propelled by emerging Asia and information technology firms. However, we recommend investors closely observe developments in emerging markets during the first quarter before finalizing any investment decisions.

2024 Outlook: China’s Economic Downturn Expected to Ease Slightly

Anticipated to swiftly rebound in 2023 and reclaim its position as the predominant driver of global economic growth, the Chinese economy, contrary to expectations, experienced a setback, reaching a level where it is now characterized as a hindrance to worldwide output, as noted by the International Monetary Fund (IMF) and other sources. Despite numerous challenges such as a property crisis, weak spending, and high youth unemployment, the consensus among most economists was that the world's second-largest economy was expected to achieve its official growth target of approximately 5% in 2023.

Responding to the slow economic recovery, policymakers initially implemented incremental stimulus measures. Since the initial measures proved insufficient, more significant actions were implemented during the autumn. Notably, in October, there was an unusual issuance of 1 trillion yuan ($140 billion) in sovereign debt to bolster infrastructure spending.

The Chinese economy expanded at a rate of 5.2% during the initial three quarters of the year and exhibited signs of improvement in November, marked by increases in both factory output and retail sales. However, property investments witnessed a decline of 9.4%, as reported by the National Bureau of Statistics. It suggests that the real estate sector is still grappling with a crisis, leading numerous developers to default on debts amounting to hundreds of billions of dollars.

In recent years, China's economy has experienced fluctuations, ranging from 2.2% in 2020 to 8.4% in 2021, followed by a 3% growth in 2023. The stringent restrictions on travel and other activities amid the pandemic adversely impacted manufacturing and transportation. Job losses resulting from these disruptions, coupled with a regulatory crackdown on the technology sector and a downturn in the property industry, have prompted many Chinese individuals to adopt more cautious spending habits.

The International Monetary Fund (IMF) has adopted a more pessimistic view of the extended economic outlook. In November, it expressed the anticipation of China's growth rate reaching 5.4% in 2023 and gradually decreasing to 3.5% in 2028, citing challenges such as weak productivity and an aging population.

Considering the bleak outlook in the property market, it's challenging to anticipate a robust recovery in household consumption. Despite recent data indicating a deceleration in the rate of savings accumulation by Chinese households, the persistent correction in home prices is expected to persist in 2024, exerting a dampening effect on consumers' inclination to spend.

Looking at the brighter side, we believe that investments in manufacturing are expected to stay robust, driven by the government's sustained efforts towards higher-quality development, with a focus on decarbonisation and achieving technological independence. Additionally, exports are anticipated to experience a modest rebound in 2024 following a significant correction in 2023. This is attributed to the stabilization of Western demand for goods and China's ongoing strong performance in exports related to the green transition.

2023 Year-End Recap: Reviewing the State of India’s Economy

Emerging as the world's fastest-growing economy for the past two years, India encountered numerous developments in 2023 that bolstered foreign investor confidence. S&P Global projects robust economic growth for India in the medium term, anticipating annual GDP expansion of 6-7.1% in fiscal years 2024-2026. Notably, India's real GDP exhibited a year-on-year growth of 7.8% in the initial quarter (April to June), surpassing expectations. Furthermore, preliminary estimates from the National Statistical Office indicate a remarkable 7.6% growth in the third quarter of 2023. While the growth in the second quarter at 7.6% was slightly lower than the first quarter's 7.8%, it notably exceeded the central bank's forecast of 6.5%. India's GDP has consistently expanded at a commendable pace, securing its position as the world's fifth-largest economy, trailing Japan and surpassing the United Kingdom.

India Manufacturing PMI 2023:

The S&P Global India Manufacturing PMI rebounded to 56.0 in November 2023, recovering from October's eight-month low of 55.5, aligning with market expectations. It marked the 29th consecutive month of expanding factory activity. The manufacturing sector in India also experienced a resurgence in new orders, bouncing back from October's one-year low. Foreign sales extended their growth streak for the 20th month, albeit at the slowest rate since June. Additionally, employment saw its eighth consecutive monthly increase, accompanied by a slight uptick in outstanding business. Notably, the increase in buying activity and input stocks was remarkable, largely driven by robust demand conditions. In October 2023, the output of eight key infrastructure sectors rose sharply by 12.1%, in contrast to the 0.7% expansion in the year-ago period. A significant increase in the production of coal, steel, cement, and electricity fuelled this upswing. These eight core sectors, including coal, crude oil, natural gas, refinery products, fertilizer, steel, cement, and electricity, collectively contribute 40.27% to the Index of Industrial Production (IIP).

Experiencing a +12.4% increase in the July-September quarter, government spending rebounded following a contraction in the April-June quarter, possibly influenced by the anticipation of crucial state elections in November.

Amidst sluggish consumer spending and a delayed private sector investment, the government unveiled ambitious capital expenditure (capex) plans in the Union Budget announced on February 1, 2023. A significant ongoing challenge for India revolves around revitalizing demand in the rural economy.

We believe that the country's strong economic path will be supported by its enduring growth and advantageous demographics. India, being the most populous nation globally with a median age of 28.2 years, is well-positioned for recovery in domestic demand. It holds particularly true for private consumption and household spending, which are vital for fostering business growth in the aftermath of an extended pandemic. Contributing to this optimistic outlook are India's large consumer base, escalating urban incomes, and the aspirations of the world's largest young population.

Disclaimer:

The commentary you find on this page is for information only; it is not intended as research or a recommendation suitable to your individual circumstance. Please seek financial advice from a professional before acting on investment decisions.

As is the very nature of investing, there are inherent risks, and the value of your investments will both rise and fall over time. Please do not assume that past performance will repeat itself and you must be comfortable in the knowledge that you may receive less than you originally invested.

Comments