Insights

January 2023 Market Commentary

By

Belvedere Group

The United States reaches its debt ceiling, causing investors to speculate on how it could affect financial markets. Global Interest rates and inflation projections for 2023, as the early signs of declining prices in the US and Europe have spurred policymakers into slowing down the pace of rate hikes.

Markets Summary

As the first month of the new year is beyond us now, an analysis of the monthly performance of the MSCI World index, our benchmark for developed markets equities delivered a net return of 7.08% MTD. The S&P 500 which makes up about 68% of the developed markets returned 6.25%, with the consumer discretionary sector driving the return on both the MSCI developed and S&P 500 index. Although, consumer discretionary stocks suffered the most in 2022 due to inflation rates at a 40-year high, which resulted in the Fed hiking the benchmark interest rate to its highest level in 15 years and its stringent monetary tightening which raised the risk-free market interest rate to a two-decade high. This reinforced the fact that higher interest rates are detrimental to growth sectors like consumer discretionary.

Top 5 Performing Developed Markets Stocks MTD:

Looking forward to the rest of 2023, we believe that consumer discretionary stocks will start to rebound because peak inflation seems to be behind us as we observed less-than-expected inflation rates in the last three months of 2022. Other factors include the fact that the headwind of the pandemic is history as China’s economy re-opens, and the US labour market remains resilient as demonstrated by the latest earning season. This makes us believe that the Fed may have achieved its goal of a soft landing on the economy. Zooming into the UK, the FTSE 100 had a net return of 6.79% MTD, the Bank of England (BoE) hiked interest rates by 50 bps last Thursday and dialled back on its previous bleak economic forecasts. However, the IMF downgraded its projection for UK GDP growth in 2023 to -0.6%, which makes it the world’s worst-performing major economy, behind Russia. This caused the sterling to fall 0.7% against the dollar, and the gilt yield tumbled as the BoE signalled that rates were nearing a peak, whilst not completely dropping the remedy of further tightening should it be required.

In last month’s market update, we emphasized the importance of being selectively contrarian in your investment strategies in 2023, on that note, we analysed the performance of various investment strategies in the MSCI developed markets index.

Developed Market Caps Performance:

As you will observe in the chart above, mid-cap stocks have outperformed both their large-cap and small-cap counterparts, by achieving an annualized return of 10.95% over the last 10 years, compared to the 5.88% and 7.27% returns generated by large-cap and mid-cap stocks respectively. Some of the benefits of investing in mid-cap stocks include the fact that they are less susceptible to market volatility relative to small-cap stocks, thus, they tend to perform better in times of economic turbulence. It is crucial to continue to work with your wealth advisor to help you understand what strategy best suits your investment objective.

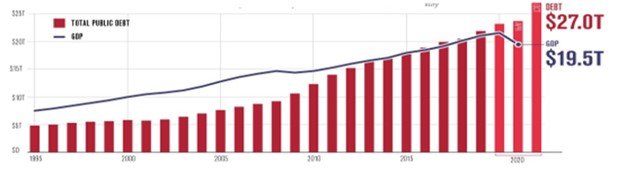

The United States Hits Statutory Debt Limit

The US reached its debt limit in January following the failure of lawmakers to reach an agreement leading to a default in the world’s largest economy. The Treasury Department was forced to play defence last month to pay its dues as the federal government bumped up against its $31.4 trillion borrowing limit, reinforcing the need for a political stand-off to raise the debt ceiling later this year. Goldman Sachs Research Chief U.S. equity strategist commented that “The current political environment shares some similarities with 2011 when a debt-limit standoff caused significant disruptions. The S&P 500 fell by 17% from peak to trough in just 22 trading days.” He also stated that these events only have a limited impact on equities as the S&P 500 had a median peak-to-trough decline of just 4% in the last five episodes, with none besides 2011 triggering a drop of even 5%.

United States Debt vs GDP (Trillion USD):

Global Interest Rate and Inflation Projections

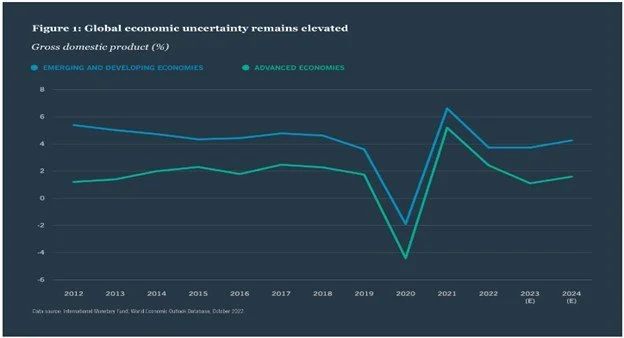

The latest shreds of evidence show that monetary policy tightening is beginning to slow down as inflation has peaked across the developed economies. In the US and Eurozone, prices of fuel and nonfuel items have been falling, causing a decline in headline inflation. In response, the US federal reserve at its first Federal Open Market Committee meeting (FOMC) raised its benchmark interest rate by 25 bps to a new range of 4.5%-4.75%.

This hike signalled the eighth consecutive interest rate increase in the US since last year's rates were kept at record lows following the pandemic outbreak. We believe that the actions of apex banks in developed economies signal their commitment to bring inflation under control to their preferred target rate of 2% even as risks to elevated prices remain present. As the world’s largest economies remain fragile to a recession, we anticipate the early signs of slowing prices to cause a slowdown of subsequent rate increases. As such, a coordinated global reduction in rate could see a slowdown in growth averted, but at a gradual pace.

Monthly Emerging Markets Update

Executive Summary

Lunar new year saga as China re-opens seeing the world’s greatest migration along with a spending spree that has had a seasonal impact on emerging markets economies.

India’s second-largest conglomerate, Adani Group’s fraud scandal wiped $100 billion from its market value, given that it was the highest-performing stock in the emerging markets index in 2022.

Market Summary

The MSCI emerging markets (EM) index returned 7.91% indicating a good start for the year. The index performed better compared to the previous month which had a return of -1.35%. On a year-to-date (YTD) basis, both EM equity and debt have outperformed their peers in the U.S. This is attributed to tailwinds such as an accelerated reopening of China; enhanced risk sentiment towards credit, and a weaker U.S. dollar. An improving economic backdrop across the EM region also supports the expectations of stronger returns as the GDP growth of EM countries are forecasted to outperform that of advanced economies over the next two years as displayed in the chart below.

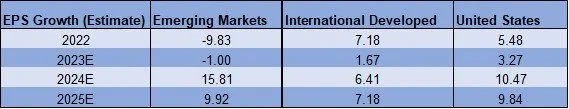

In light of the positive economic outlook for EM countries, EM equities could be rewarding for investors with higher risk tolerance, seeking higher returns. An analysis of the EM equities valuation shows that they are well below their long-term averages and remain cheaper compared to the U.S., According to FactSet, forecasted EPS growth estimates from 2024 to 2025 are more attractive than developed markets. However, as we carry on with 2023, earning expectations are not on the positive side for EM stocks, which is notably the first negative forecast since 2009. Although, we believe that China will be the magic pill to renew the optimism for EM stocks, including the possibility of a cease-fire from the geopolitical issues.

MSCI EM Index EPS growth estimates (%):

Whilst comparing the risks and benefits of investing in EM stocks, it is crucial to work with your wealth advisor to help you identify if it is an asset class that is aligned with your long-term goals, and as we did in our developed markets piece, we have also visualized (below) the investment strategy that has outperformed over the last ten years and found that large-cap EM stocks have outperformed both mid and small-cap stocks in the index.

MSCI EM MTD Top 5 Contributors as of January 31st, 2023:

We believe that this is attributed to the fact that large-cap EM stocks are more liquid and act as a defence compared to their counterparts. Although, EM stocks are more volatile compared to developed market stocks, large-cap EM stocks such as Taiwan Semiconductor, Alibaba, and Samsung help in reducing the exposures to areas most at risk. As you will observe in the chart above, large-cap EM stocks contributed the most to the MTD return on the index.

EM Market Cap Performance over the last 10 years:

Lunar new year saga as China re-opens

Markets in the Asia-Pacific region traded higher and currencies were damped as the Lunar New year holidays were observed in most of the region. Major Asia-pacific countries like China, Hong Kong, Taiwan, South Korea, Malaysia, and Singapore, which constitute over 63% of EM stocks were closed for a week as the public holiday lasted for seven days. It is important to note that although these large economies were closed, the tourism, transportation, and retail sectors went into overdrive. In the merry of this holiday, China’s official manufacturing purchasing managers’ index (PMI) rose to 50.1 in January, above the 50-point mark that separates growth from contraction. This is a positive sign that highlights the fact that earlier reopening and peak infections have set the stage for China’s economic recovery.

India’s second-largest conglomerate, Adani Group’s fraud scandal

Adani is an important company to dive into as one of its subsidiaries Adani Enterprise drove the EM index in 2022, with a return of 103%. In the month of January, it returned -22.16, making it one of the lowest-performing stocks MTD. The fraud scandal of the Adani group raised concerns amongst investors that valuations might be inflated. The stock was sent on a downward spiral after it was accused by the Hindenburg research of large-scale corruption and misconduct.

Adani Enterprise’s stock performance:

The Hindenburg research claimed that the group was engaged in a stock manipulation, and accounting-fraud scheme, and vastly overstated its companies' valuations in an attempt to "maintain the appearance of financial health and solvency". Since the report was released, the Adani Group has lost over $100 billion in market value. India has successfully differentiated itself from other emerging markets, including China, through the quality of its market regulator and protection for minority investors. However, the scandal in Adani has put investor trust in India in doubt and presents various challenges to its institutions.

As continuous learners, we reflected on some key takeaways from Ted Seide’s Capital Allocators podcast titled “You won’t detect the next fraud.” This taught us that fraud is a risk you bear in every investment. Sometimes, you can’t avoid it because as thorough the due diligence process may be, it is almost impossible to detect the next fraud, but the measure can be to diversify prudently and understand that what ends up as fraud may start as a legitimate business. More key takeaways are; fraudsters spend 100% of their time staying two steps ahead of investors. Hence, an investment that looks promising may end up being a fraud, focus on what you can control, and spend less time detecting fraud because it could cost you time analysing legitimate businesses and we can never understand professional relationships with 100% certainty. These takeaways will remain top of mind as we continue to analyse EM & DM markets going forward.